The Night I Lost Everything In America — And The One Thing That Could’ve Saved Me

In November 2021, my life changed forever.

Not from a car accident.

Not from bad choices.

But from a stroke I never saw coming.

I Lost Everything In America When I Got Sick.

I’m Here To Make Sure It Never Happens To You.”

One sickness ended my income, my insurance, my stability… and nearly destroyed my family.

If you’re living in America without critical/chronic illness protection, you’re one emergency away from the same disaster.

Let me show you the system that would have saved me:

In November 2021, I learned the hard truth about life in America:

You don’t need to die to lose everything.

You just need to get sick.

At 7 PM, I was perfectly fine.

By 9 PM, I was fighting for my life after a massive stroke.

The ambulance.

The hospital.

The doctor’s words:

“You’ve had a severe stroke.”

Everything changed.

I lost my job.

I lost my income.

I lost my health insurance.

Bills piled up faster than I could breathe.

I sent my daughter away so she could be cared for.

I slept on a friend’s couch — learning to walk again.

I was a father with no ability to provide.

A man with no protection.

A provider who suddenly needed to be provided for.

It wasn’t the stroke that nearly destroyed me…

It was being unprotected in a country where sickness is expensive.

I realized something that night:

Living in America without critical illness protection is financial suicide.

If I had income replacement…

If I had living benefits…

If I had proper coverage…

I wouldn’t have lost my home.

I wouldn’t have lost my stability.

I wouldn’t have failed my daughter.

That pain became my mission.

Today, I help make sure no one else waits the way I waited.

Because the one lesson life taught me is this:

The waiting game is the losing game.

Protect yourself before life forces you to.”

“In November 2021, a massive stroke changed my life in two hours.”

I went to bed around 7 PM…

By 9 PM, I couldn’t move or speak properly.

The doctor at St. Joseph Hospital looked me in the eye and said:

“You’ve had a massive stroke.”

Weeks in the hospital.

Months of recovery.

Then the real pain started:

• I lost my job

• I lost my health insurance

• I didn’t qualify for Medicaid right away

• Hospital bills piled up

• I couldn’t pay rent

• I couldn’t care for my daughter

• I slept on my friend’s couch while relearning to walk

I felt like I failed my daughter.

I felt like I failed my family back home.

I felt like I failed myself.

And all of it happened because I was living in America with no protection for critical or chronic illness.

THE WAKE-UP MOMENT

Lying on my brother Morris Varney’s couch, staring at the ceiling, it hit me:

“Living in America without protection is a disaster.

One sickness can wipe out your entire life.”

I learned the hardest lesson of my life:

The waiting game is the losing game.

THE SOLUTION

During my recovery, I discovered something I wish I had known before the stroke:

There are insurance plans in this country that:

✔ Pay you when you get sick

✔ Replace your income

✔ Cover chronic and critical illness

✔ Protect your family

✔ Keep your life stable when you can’t work

These living benefits would have changed everything for me.

They can change everything for you too.

Don’t wait.

Don’t gamble.

Don’t repeat my mistake.

The waiting game is the losing game.

Protect your life while you still have the chance.

This Free Session is specifically for you if you are:

• An African immigrant working hard in America

• Supporting family back home

• Living paycheck to paycheck

• Scared of emergencies

• Carrying the whole family on your back

• Without a system that protects your income

This is exactly who I created this for.

WHAT YOU’LL GET IN YOUR SESSION

In this free session, I will help you:

✔ Understand exactly where you are financially

✔ Identify your risks if illness hits

✔ Create a protection system that pays YOU when you can’t work

✔ See how income replacement really works

✔ Build the safety I didn’t have when I needed it

No pressure.

No sales tricks.

Just clarity and protection.

Listen to me well:

If I had the right protection before 2021,

my story would have been completely different.

• I wouldn’t have slept on a couch

• I wouldn’t have drowned in bills

• I wouldn’t have lost my home

• I wouldn’t have lost my peace

• I wouldn’t have sent my daughter away

I suffered because I didn’t know better.

And now my mission is simple:

No African immigrant should ever live one sickness away from destruction.

The Real Benefits of an Indexed Universal Life (IUL)

1. Income Replacement When You’re Alive

If you get sick, injured, or disabled, an IUL with living benefits can pay you while you’re still alive.

Not GoFundMe.

Not borrowing.

Not begging family.

👉 This means rent gets paid, food stays on the table, and your kids stay stable even when you can’t work.

2. Protection From Critical & Chronic Illness

Stroke. Cancer. Heart attack. Chronic illness, etc.

These are not rare. They are common.

And they don’t ask permission.

👉 An IUL gives you cash when illness hits, so recovery is about healing, not panic.

3. Your Money Grows Without Market Risk

Your cash value grows linked to the market, but you’re protected from market crashes.

When the market goes up → you participate and make profit.

When the market goes down → you don’t lose your money.

👉 This is growth without gambling.

4. Tax-Advantaged Growth

Your money inside an IUL can grow tax-deferred and be accessed tax-free if structured properly.

👉 That means more money stays with your family, not taken by taxes.

5. Access to Your Money Anytime

This is not “locked away” money.

You can withdraw or borrow from your policy to:

fix a car

cover emergencies

avoid high-interest debt

invest in yourself

Pay for your child college

👉 Your money works while you use it.

6. You Become Your Own Bank

Instead of running to banks or credit cards, you borrow from your own system.

👉 No credit checks.

👉 No approval process.

👉 No shame.

And your money keeps growing even while you borrow.

7. A Death Benefit That Protects Your Family

This is not the main reason — but it matters.

If something happens to you, your family receives tax-free money to:

pay off debts

keep the house

send kids to school

avoid financial collapse

👉 This is legacy, not sympathy.

8. Flexibility When Life Changes

Life changes. Jobs change. Income changes.

An IUL is flexible:

adjust contributions

access cash

adapt as life evolves

👉 It moves with your life, not against it.

9. Peace of Mind

This is the real benefit.

Knowing that:

one sickness won’t destroy everything

your kids will be okay

your family won’t suffer

you won’t lose your dignity

👉 That peace is priceless.

10. You Stop Playing the Waiting Game

Most people say:

“I’ll do it later.”

“I’ll wait until I make more.”

“I’ll do it next year.”

Life doesn’t wait.

👉 An IUL rewards early action.

The younger and healthier you are, the stronger and cheaper the protection.

The Truth (Read This Slowly)

You don’t buy an IUL because you expect to get sick.

You buy it because life doesn’t warn you before it hits.

I learned that the hard way.

You don’t have to.

The waiting game is the losing game.

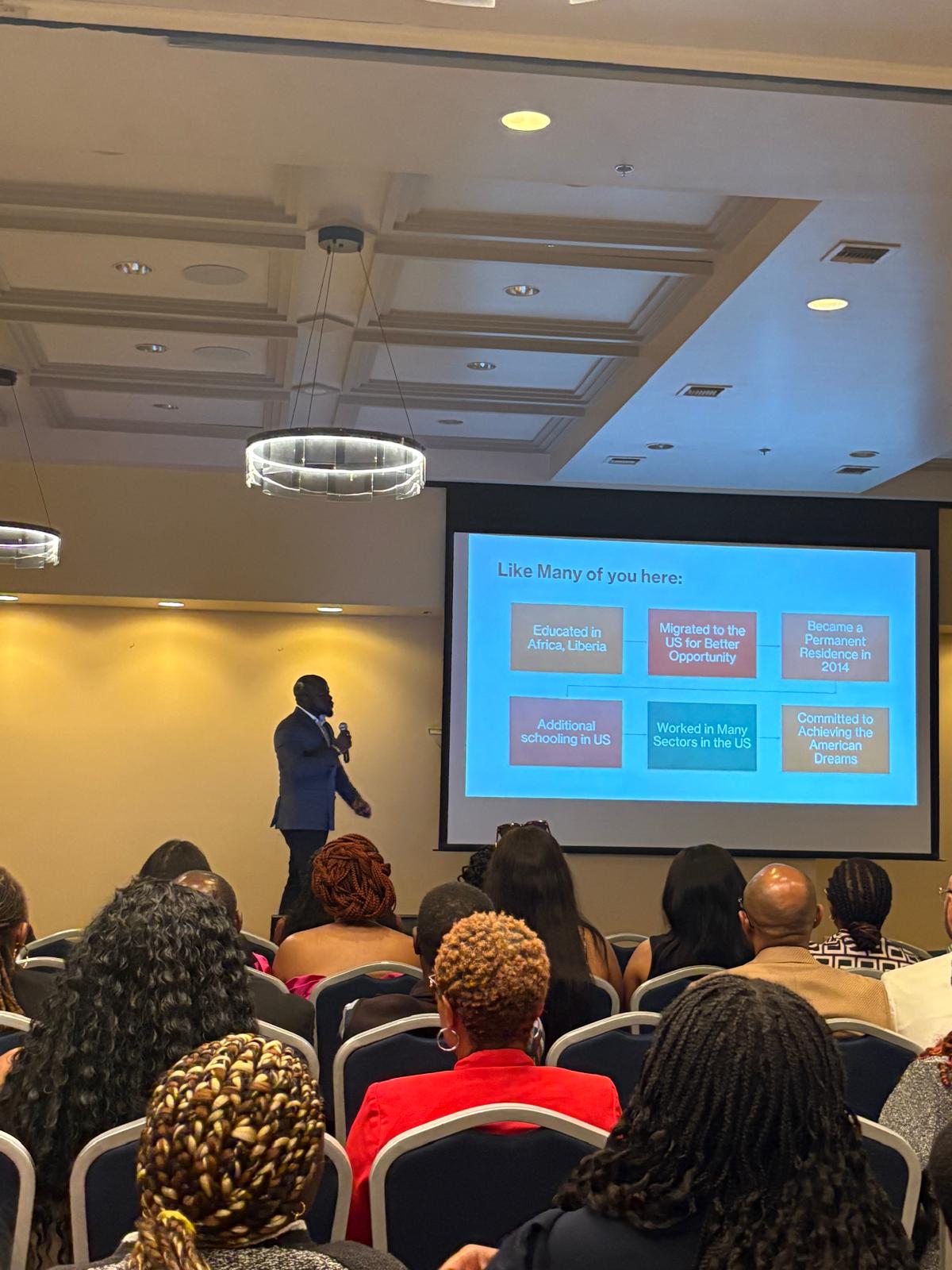

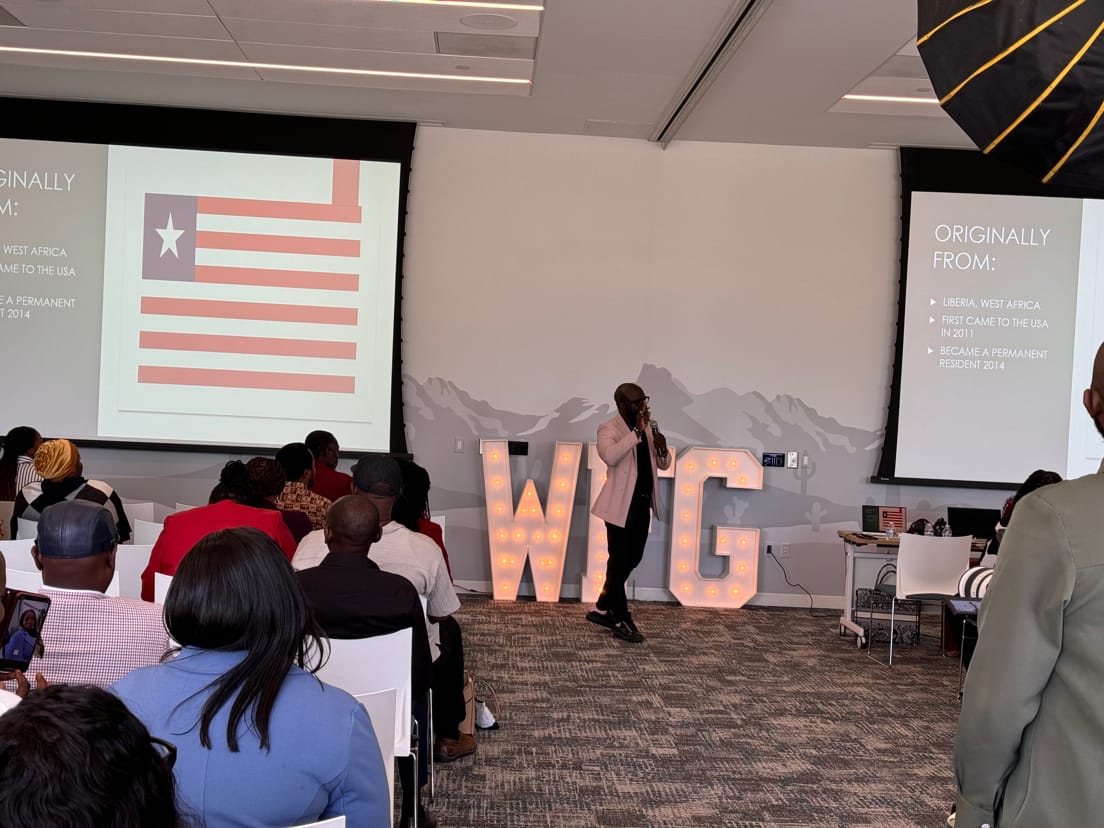

"I Didn't Choose This Work. Life Forced me Into This Mission"

Today, I travel across the United States helping immigrant families understand that:

1. Protection before Profit.

2. Survival is not Success.

3. Income must be Protected before it's grown.

4. Legacy starts while you're alive.

5. The Waiting Game is the Losing Game.

“I help African immigrants move from survival mode to structured protection — so one sickness doesn’t destroy everything they’ve built.”

Hard work is not enough

Sickness is more dangerous than death financially

Protection must come before wealth

Waiting is the most expensive decision

Legacy starts with stability

From Survival to Structure

I've helped over 350 immigrant families secured their financial future and built generational wealth for their children yet unborn.

Testimonials

Aaron Gaie

After exploring several options that weren't good enough, Harry introduced me to IUL. I am so grateful that he did. Today, every single person in my family is covered and protected!

Esther Gibson

I am incredibly grateful to Harry for exposing me to IUL after putting our meeting off for months. I am now glad that I gave him the opportunity to help me build a system that works on my behalf.

Vincent Cooper

Explored several options for self-employed safeguards, but Harry and his team really stood out. Their tailored policies bring some peace of mind to the freelance hustle and even everyday working class.

FAQs

Your Questions Answered: Quick Insights on Saving Your Future

What Is an IUL?

An Indexed Universal Life policy is a financial system that protects your income, grows your money, and creates a legacy for your family.

Income protection insurance provides you with part of your usual earnings if illness or injury prevents you from working.

Why People Need IUL?

To replace income if sickness stops work

To protect against critical & chronic illness

To grow money without market loss

To access cash without penalties

To leave tax-free money to family

Eligibility includes being within a specific age range, having a steady income, and good health when applying.

How Does It Helps You While You're Alive?

Pays you during serious illness

Gives access to cash value

It allows your money grow while you use it

How Does IUL Helps Your Family?

Tax-free payout

Debt protection

Housing stability

Legacy transfer

Income protection insurance provides you with part of your usual earnings if illness or injury prevents you from working.

What's The Real Advantage of IUL?

You stop depending on jobs, banks, and luck.

You build certainty.

Eligibility includes being within a specific age range, having a steady income, and good health when applying.

The Single Most Important Truth of IUL?

The earlier you act, the stronger and cheaper this protection is.

Waiting makes it harder. Sometimes impossible.

The waiting game is the losing game.